Something about IRA

I’m starting a new series, of Finance. Looked into IRA, backdoor, and mega backdoor. These CPA domain knowledge shouldn’t be too hard for STEM background ppl. So there are the notes from this video.

0 Basic concepts

- Tax-deferred: Defer tax to retirement, like 401K. You will still need to pay tax on it when

- Tax free: Totally no tax, which is the best case.

- After tax: Already have tax paid

| Contribution | Capital Gains | |

|---|---|---|

| Traditional | tax-deferred | tax-deferrd |

| After-Tax | after tax | tax-deferred |

| Roth | after tax | tax free |

Some reference are from zhihu and references in this one. Will read later. Link

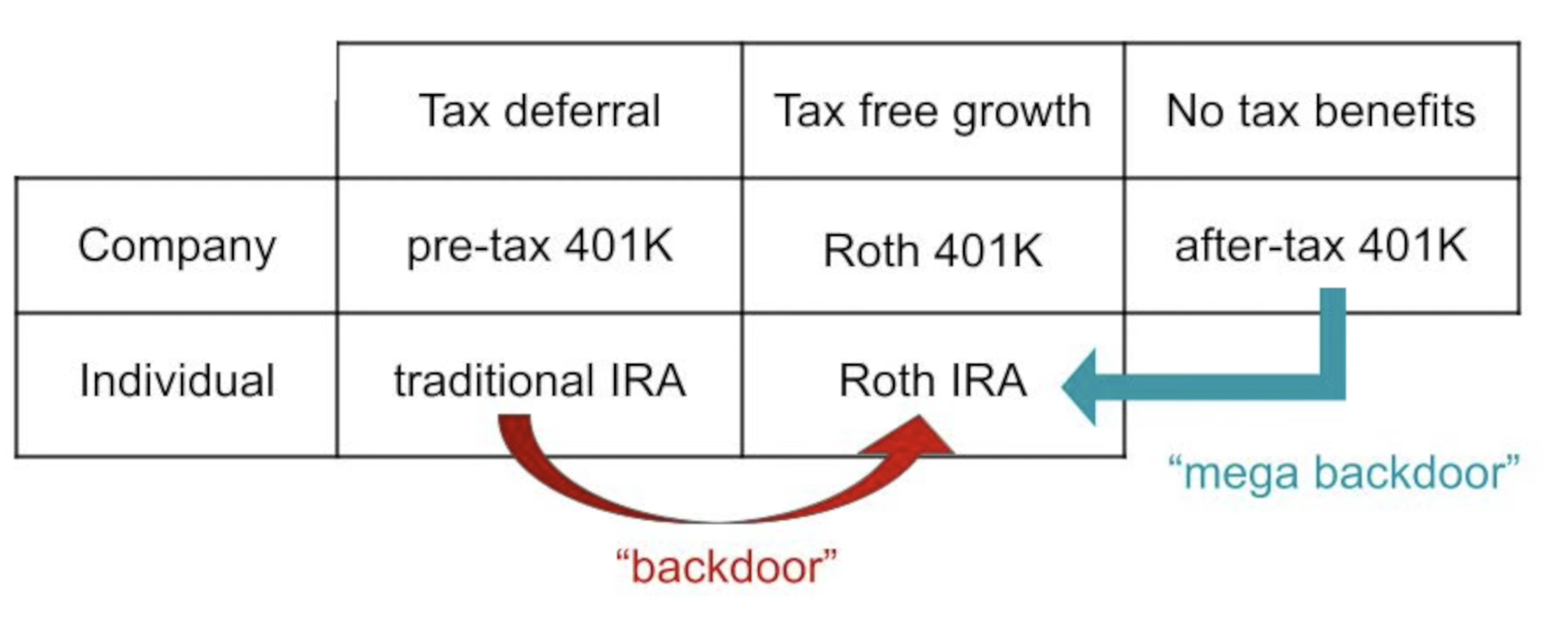

1 Overview

This is the best overview chart I have seen so far.

401K will have penalty from 59.5.

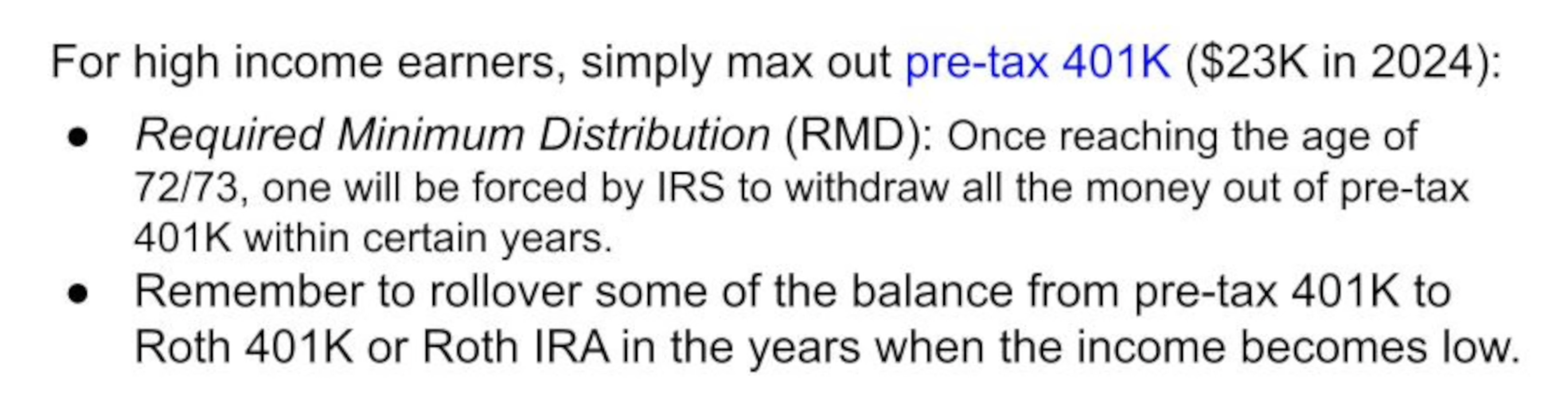

After ~72, there will be RMD forced to withdraw from 401K

401K will have penalty from 59.5.

After ~72, there will be RMD forced to withdraw from 401K

Can use BridgeLink to have more option in 401k (ETF, not stocks)

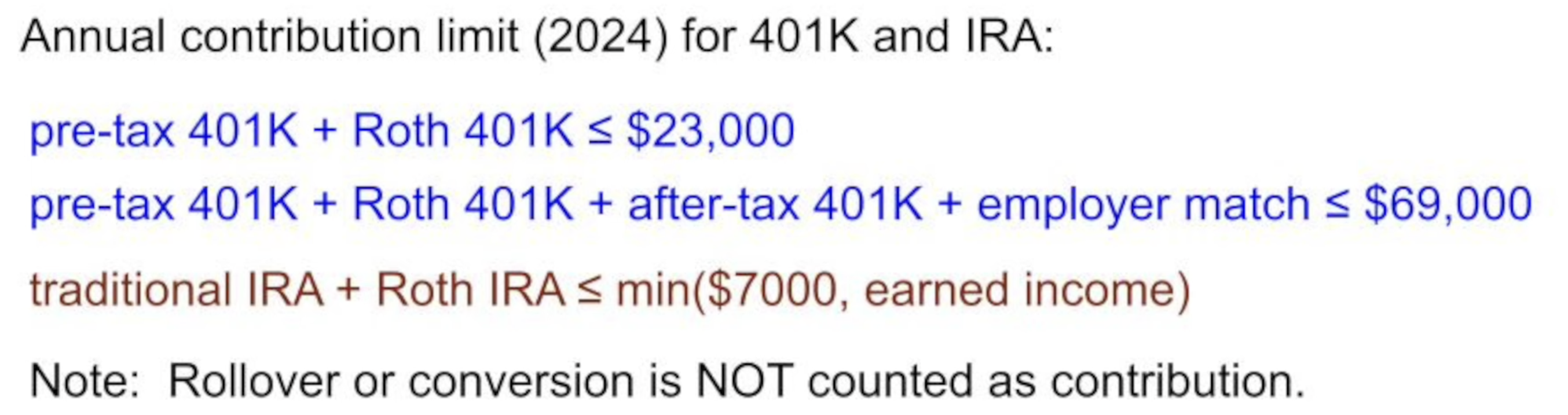

Here are the limits for each.

Can use BridgeLink to have more option in 401k (ETF, not stocks)

Here are the limits for each.

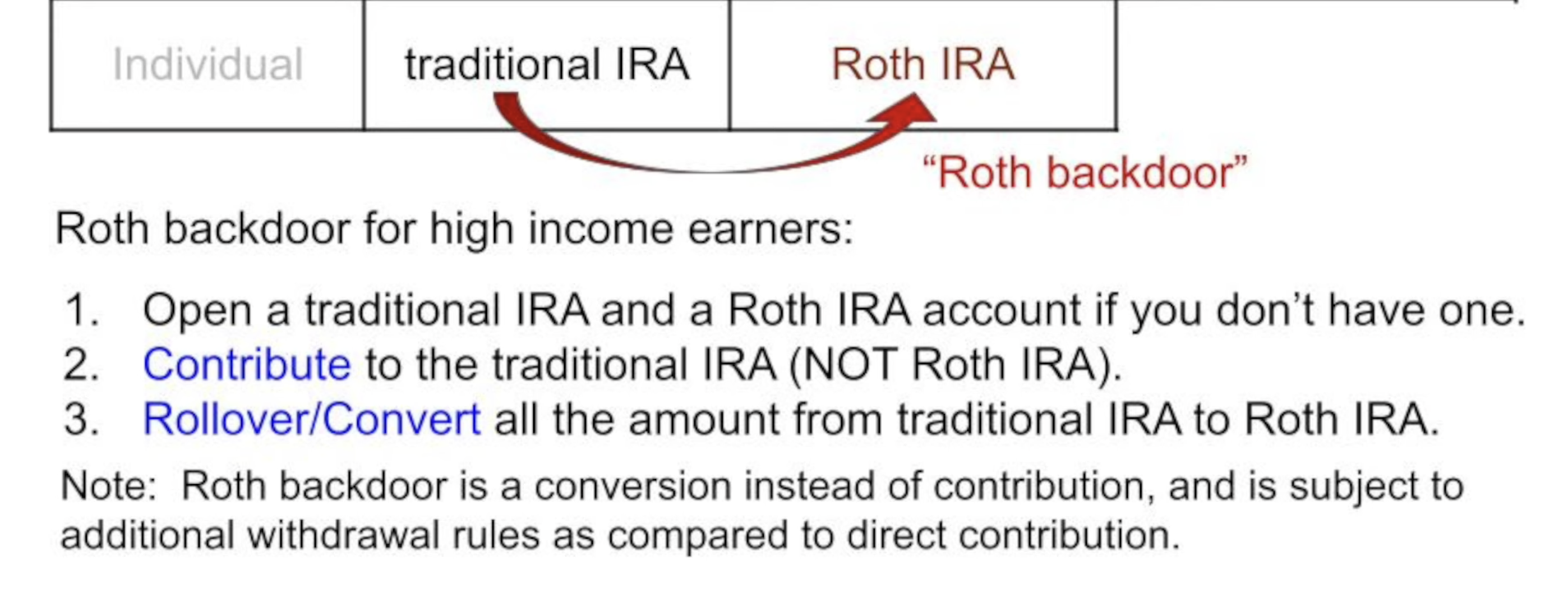

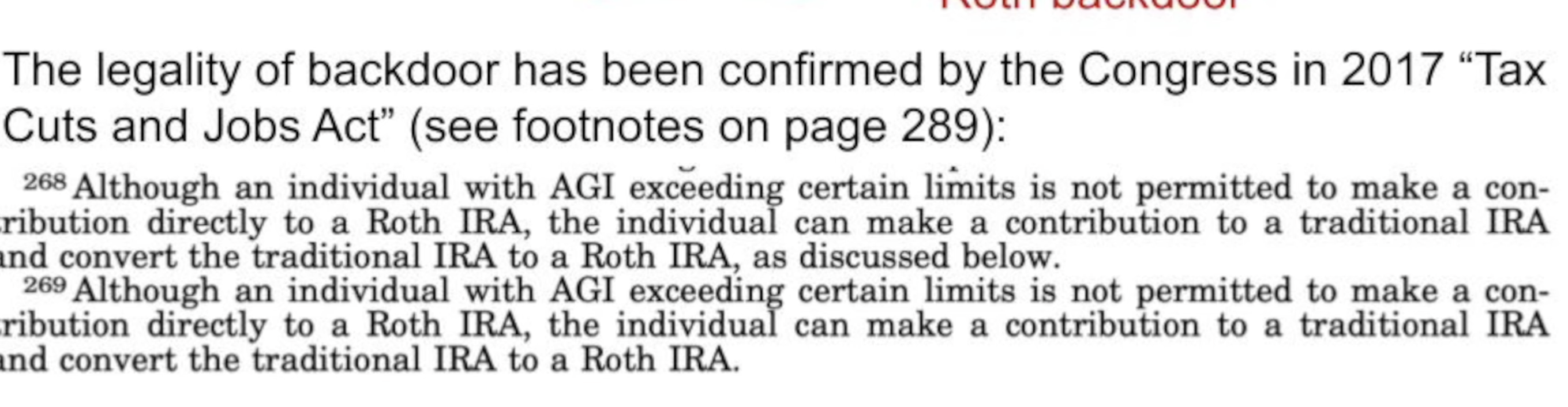

2 Roth backdoor

This is fully legal now

This is fully legal now

- Do NOT contribute pre-tax dollars to traditional IRA like converting pre-tax 401K to traditional IRA when leaving a job (so backdoor to Roth IRA ASAP)

- Keep zero balanced in traditional IRA before and after backdoor

- Otherwise, one have to follow the pro-rata rule fo Roth conversion

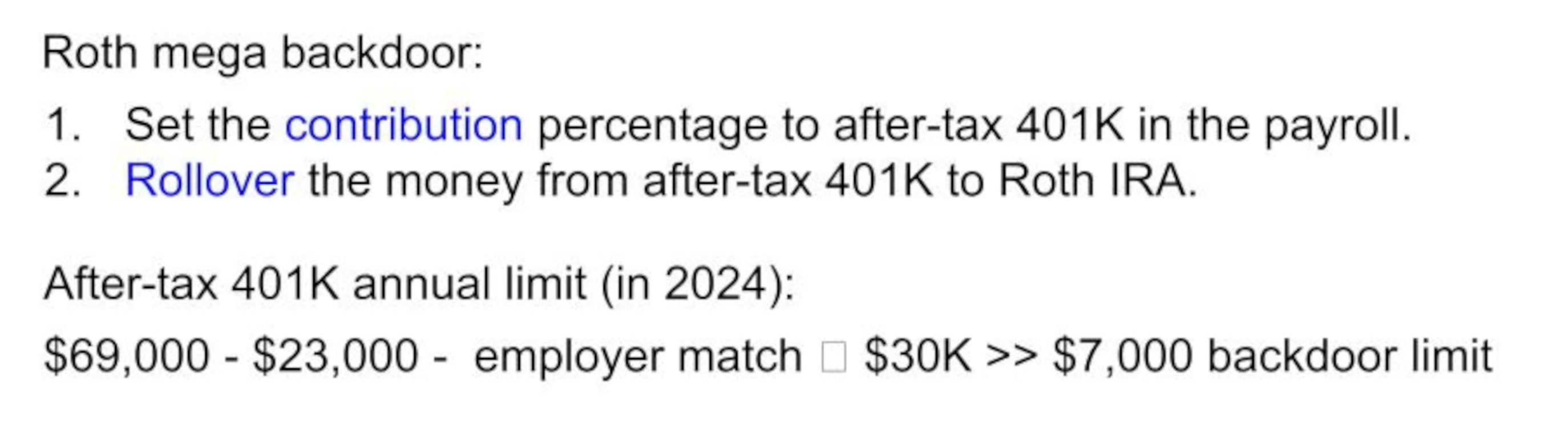

3 Mega backdoor

Use after-tax 401k, to use mega backdoor. Nvidia supports Nvidia Just use 1099 from 401K for tax return purpose